One of the best ways to excel at lead generation is to treat it as an investment. You invest in leads (by purchasing them or running campaigns) with the hope of bringing a positive return on investment. ROI, in this case, is revenue.

The investment approach puts a little extra pressure on demand gen managers to measure and prove results . . . which can be intimidating, considering 80 percent of marketers have a hard time demonstrating ROI.

ALSO READ: How to Buy B2B Leads that Generate the Most ROI

Waiting is the worst part. Say you acquire a list of MQLs and deliver them to sales at the end of Q1, but it takes 30 days just to move a small percentage to the SAL stage, and those few lie dormant in your CRM for what seems like an eternity. You paid good money for those leads, and your higher-ups want answers. Why aren’t they converting yet? When can you expect to see some opportunities? How long will it take to generate revenue?

These questions are tough to answer on a global level, especially since there are so many different opinions about the length of the B2B sales cycle. In 2012, MarketingSherpa said it was getting shorter. In 2013, Crain’s BtoB Magazine said it was getting longer.

The reality is, sales cycle length and time-to-ROI aren’t the same for any two companies. They’re influenced by your sales process, by the size of the potential deal, and by the current funnel stage of your leads. The answer to all your ROI questions? It depends.

The Impact of Deal Size

Deal size refers to the value and scope of a potential customer relationship. This varies depending on your product or service and your ideal customer profile. If you’re an ERP software vendor that targets large enterprises in industrial manufacturing, your average deal size will be fairly large. If your product is a cloud-based accounting tool for small businesses, your deals might be a bit less substantial.

Here are some of the main components of deal size for most B2B vendors:

- Scale (how many users, administrators)

- Implementation (integration services, custom development, multi-site installation, data migration, etc.)

- Cost (pricing tier, monthly/annual subscription, fees)

- License Type (On-demand, or perpetual license)

- Service/Support (ongoing support, dedicated account manager, training)

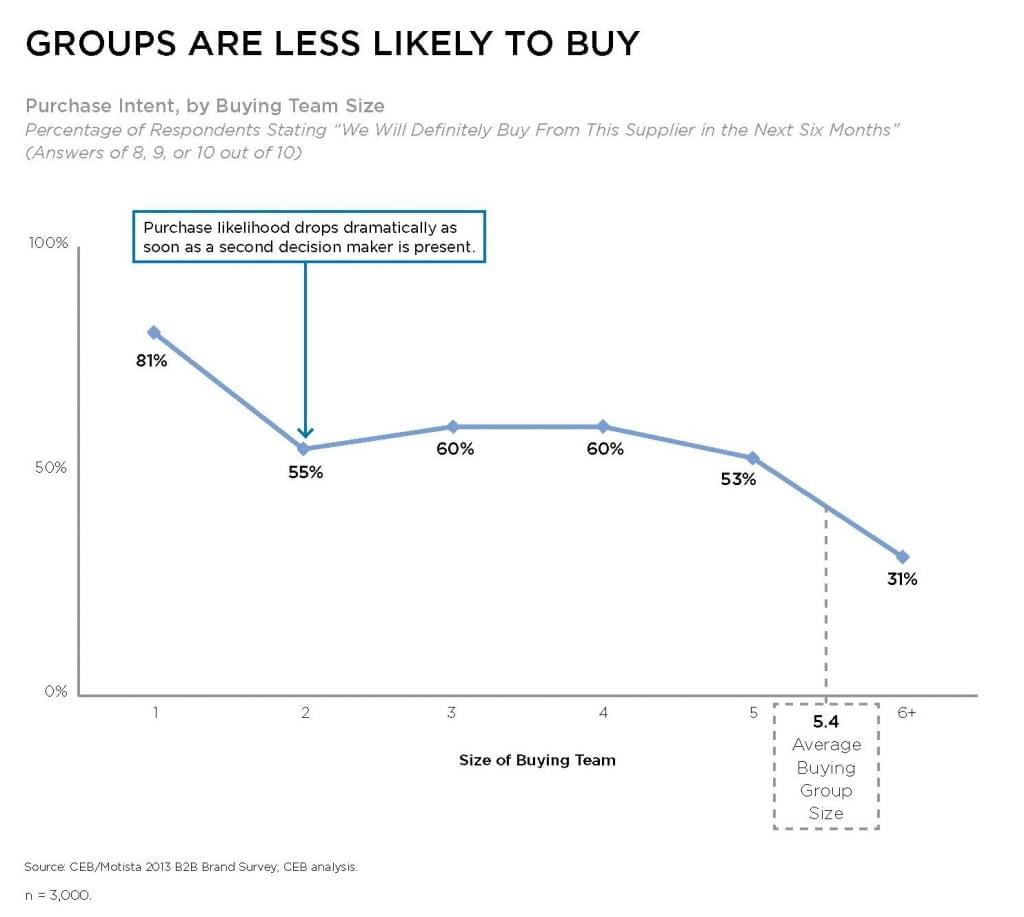

Generally speaking, the bigger the potential deal, the longer the time-to-ROI. That happens for a couple reasons. First, because bigger deals usually involve more decision-makers. The committee buying process is generally long and convoluted since it requires consensus-building among a group of leaders with diverse priorities. Ardath Albee, CEO of Marketing Interactions and esteemed author, put it this way:

“The dynamics of a group decision are emotional from inception. Each person involved in the decision will bring their perspective about the idea, the potential ways in which to solve it, turf they’re protecting, views of disruption, and willingness to accept change to the table.”

According to CEB, 5.4 people must sign off on the average B2B purchase. They suggest the consensus-building process consists of three main phases: problem definition, solution identification, and supplier selection. As you wait for opportunities to become deals, it’s important to be mindful of this process and add insight where you can. Your job isn’t to pressure the buying group, it’s to remove obstacles along the path to consensus.

So what can you do about it?

If a potential customer is in the risk assessment stage, you’ve actually gotten pretty far. At this point, try to provide reassurance through case studies or ROI calculators, and assign a dedicated rep who can answer tough questions. It’s also important to be flexible. If the opportunity is big enough, you might consider negotiating pricing or contract terms to alleviate any final hesitations.

The Impact of Funnel Stage

Every B2B organization has their own version of the sales funnel. Your stages may have their own unique implications, but for the purposes of this article, we’ll use these stages:

— > Inquiry/Lead

— > MQL

— > SAL

— > SQL/Opportunity

— > Won/Lost Deal

These stages are admittedly artificial — designed more to reflect a company’s internal sales process than the actual buying process (in fact, some research indicates buyers are 57 percent through the decision process before they engage with a supplier). But the funnel stages do parallel the buying process and the evolution of interest, intent, and commitment in your potential customers.

They also directly impact time-to-ROI. Typically, higher funnel stage = longer time to ROI and vice versa. But at the same time, the relationship isn’t black and white. You might have a lead that speeds through to the deal stage two weeks after contact. Conversely, you might see a sales-qualified opportunity drop off the radar for six months.

To give you a better idea of how this works, we’ll break it down stage-by-stage.

Inquiry

The inquiry stage marks the conversion from prospect to lead. It starts when you acquire a prospect’s contact information, whether that be from your website, from a conference attendee list, a webinar, an outbound call, etc.

There is some debate over whether or not inquiries count as “leads,” but that’s ultimately your call. In some cases, an inquiry might be nothing more than a name and email address. In other cases, an inquiry might be filtered by industry, job title, or other factors. A lot of that depends on how the lead was acquired.

Here’s what you don’t know about an inquiry:

- How clear their need is (budget, timeline, etc.)

- If they have an active project (intent to purchase)

- If they’re interested in your solution

Your task with leads at this stage of the sales funnel is obviously to pull them deeper. In many cases, that means you’ll need to make them aware of their need and help them define need in a way that points to your solution. At this stage, your biggest investment will be in lead nurturing infrastructure (marketing automation, nurture tracks, lead scoring) to bring leads closer to the deal stage. Many will defect along the way.

MQL

Leads in the MQL stage have reached a certain threshold of qualification and are ready for a follow-up from sales. Every company will have a slightly different definition of an MQL, but it’s important that your marketing and sales team agree on the same definition. HubSpot defines an MQL as “more likely to become a customer compared to other leads based on lead intelligence.”

Most of the time, MQLs understand their needs and are at least somewhat interested in your solution. They should also match some of the targeting criteria from one of your ideal customer profiles. For example: a mid-level marketing manager at a software company with 200 employees.

Your biggest investment at the MQL stage should be in the data and processes that help you identify hand-raisers (other leads should either be place back into nurture programs or discarded). That means your CRM database, and it means a team of sales reps who can make first contact.

SAL

Sales accepted leads, of course, are the leads that sales decides to pursue after an initial pass. They are confirmed as matching critical requirements and having intent to purchase. SiriusDecisions calls this “verified propensity to buy.”

The SAL stage marks the beginning of the sales development process, which can sometimes be the leakiest, most constricted part of the pipeline. In other words, a small percentage of viable opportunities will make it through, and they (usually) won’t move fast. To speed the cycle, focus on confirming buyer needs and positioning your product as superior (through case studies, demos, etc.).

SQL/Opportunity

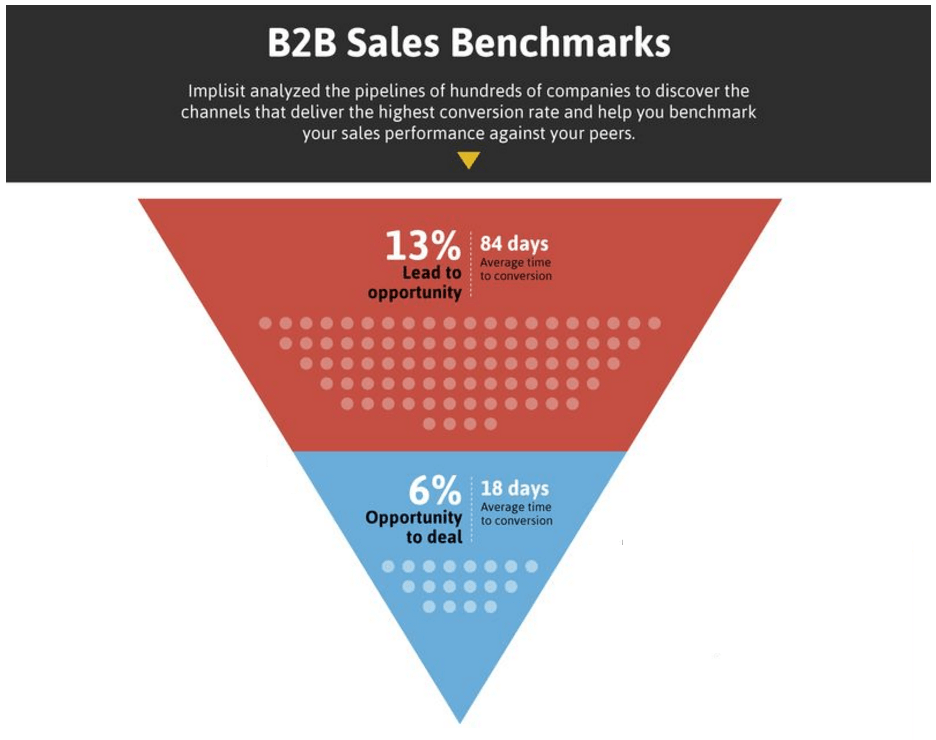

The delay between SAL and opportunity can be one of the longest points in the funnel. A study by Implisit found that B2B leads, on average, take 84 days to convert into opportunities. That’s really not surprising, considering this is the first juncture at which a buyer has to make real commitment.

In the opportunity stage, the end is nigh, but hold the champagne. Your leads will still need some time and attention before they’re ready to sign a contract. At this point, each opportunity should have a dedicated account manager (or sales development rep). Your instinct will be to accelerate the decision, but this may be a time to let off the gas. If decision-makers feel pressured, they may recoil, which explains why 37 percent of salespeople win less than half of their potential deals.

Focus on alleviating fears/hesitations and building lead priorities into the negotiation process. What does the lead want? How can you accommodate them?

Measuring Lead Generation ROI

Once your opportunities become closed-won deals and convert into revenue, you’re ready to measure ROI. Remember, you invested in your leads either by purchasing them or by building your own lead generation campaigns, or both.

If you have an integrated CRM and marketing automation platform, measuring ROI will be relatively straightforward: use closed-loop reporting to trace revenue back to the campaign, channel, and even content that produced the leads (e.g., inbound, website, white paper). At that point, there are a number of ways to attribute revenue.

With accurate data on lead flow and conversion rates, you can create better sales forecasts and decide when it’s time to launch a new campaign or partner with a lead generation service. Many times, you’ll need to plan further out than you think.

At TechnologyAdvice, our demand generation programs produce qualified leads at every stage of the funnel. We can accommodate immediate needs and not-so-immediate, big deals, small deals, and everything in between. We also speed time-to-ROI by guaranteeing lead accuracy and by following your targeting requirements to the letter. To learn more, schedule a call with our team.