Like many industries, the financial service sector needed to pump the brakes on spending in 2020 as the world dealt with the pandemic. That’s not to say the industry sat on the sidelines entirely, however.

In the US, financial services firms played a key role in the Payroll Protection Program (PPP) and other pandemic relief efforts. Some areas of the country are experiencing a real estate boom as people adjust to work-from-home and hybrid work strategies. This is driving a strong market for mortgages and homeowner’s insurance in some regions.

Does that mean financial services firms are ready to spend on IT again? Maybe. Like many industries, financial services firms are wary of uncertainty, and uncertainty is all around us. According to Gartner, IT spending among banks and securities firms fell nearly 5% in 2020, but it’s expected to grow 6.6% in 2021.

Which messages will resonate with financial services prospects?

The financial services sector and the healthcare industry have a lot in common when it comes to the challenges they face and the marketing messages that will resonate. Though the pandemic affected these two industries differently, the financial services and healthcare industries both:

- Deal with many layers of security and compliance

- Traditionally generate a lot of paperwork

- Struggle to provide the seamless, easy digital experiences their customers crave.

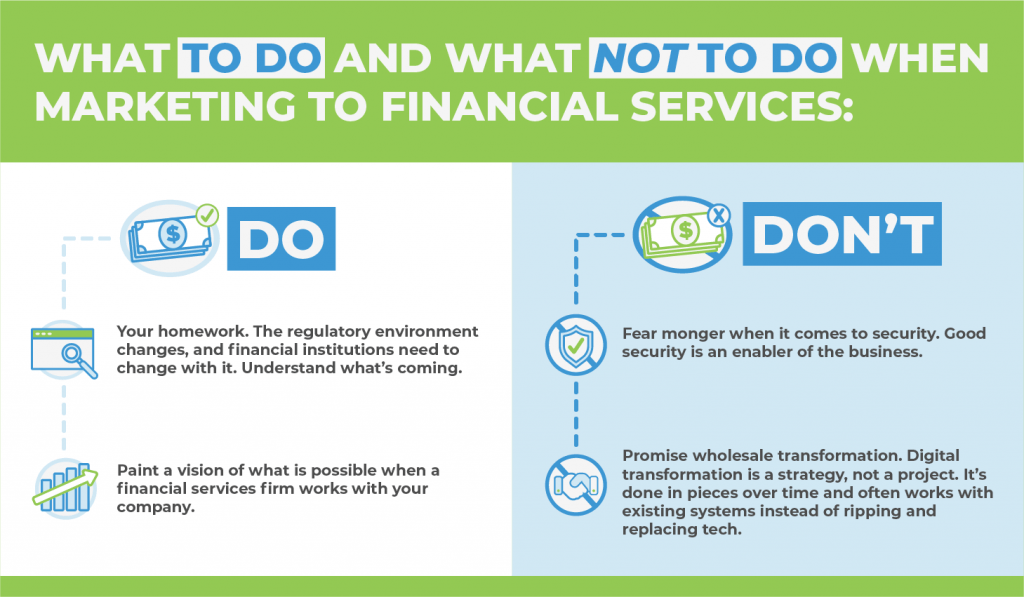

Security and compliance

Trust is paramount in the financial services sector. The reason banks were often built as large stone structures in the past was to convey the idea of security. Customers’ funds were perceived as safe in these small fortresses. In an era before deposit insurance, a bank robbery could break both the institution and its customers.

Today, the security that protects customer data is largely invisible to the users, but it’s still important. It did not take long once the pandemic started for cybercriminals to understand that consumers and businesses anxious for relief would make prime targets.

Before the end of March 2020, banks in the US, UK and Australia were already being targeted by a trojan that was hidden inside documents with titles like “Covid relief” sent by email. In May of 2020, ATM manufacturer Diebold Nixdorf was targeted in a ransomware attack. By July of 2020, the US Securities and Exchange Commission (SEC) issued a warning to financial institutions about an increase in ransomware attacks. Another warning about credential stuffing attacks on brokerages soon followed.

Security and compliance are requirements for financial institutions, and a strong record of data protection can work as a differentiator in this crowded market.

Customer experience

For many financial services customers, especially in the banking and brokerage areas, the customer experience improved significantly in the past 15 years. It wasn’t long ago that checks took days to clear and making a deposit meant a trip to the physical bank.

Customer service is yet another differentiator for financial institutions. This means delivering a seamless, easy-to-use omnichannel experience across devices. But it also means that when a customer does have to pick up the phone or visit a branch to get an answer or solve a problem, the information employees need can be found quickly and easily.

Technology that helps improve the customer experience will continue to be valued by financial services prospects for the foreseeable future.

Business process improvement

There is a direct connection between the customer experience and the business processes at many financial institutions. Websites and mobile applications can only work as fast and as seamlessly as backend processes allow.

For many institutions, loans, mortgages, and insurance policies and claims still generate reams of paperwork and require manual processes. According to Realtor.com, it still takes about 30 days on average to get a mortgage.

Speed and efficiency also function as competitive advantages in the financial services industry. It’s well known, for example, you can get an insurance quote in 15 minutes or less. Financial services prospects will be interested in technology that helps their institution get things done quickly and accurately.

Put the focus on business outcomes

It’s estimated that about 10 people are involved in the average IT purchase decision. Some of those people can talk tech. Even more of them understand when you talk about business outcomes.

Customer churn, in particular, is a business problem that everyone in financial services understands. In an ironic twist, much of the customer-focused digital transformation technology firms have deployed in the past decade actually makes it easier for customers to switch financial services providers.

Visiting a competitor’s site to open an account or get a quote is almost as easy as depositing a check with a mobile app. When a firm’s service is found lacking by customers, they can easily jump ship — and they do. Poor service is the No. 1 reason for customer churn in the financial services sector.

Delivering top-notch service and experiences creates the type of loyalty that encourages customers to expand from banking to insurance to brokerage accounts and more. It is one of the ultimate business outcomes in this sector.