Summary: This article compares how QuickBooks and Quicken approach the major small business accounting software features you need, and ends with some tips on how to choose between them.

Whether you’ve owned your own business for a while or you’re just lining up your first client, you’ll need to think about managing your money. An accounting software will help you track your income and business expenses and will make tax time less painful.

You’ve got options for small business accounting software, and QuickBooks vs. Quicken are only two of those options. To get fast, free recommendations of the best accounting software for your business, click on the banner below to access our Accounting Software Product Selection Tool or contact us today to speak to one of our Technology Advisors.

QuickBooks vs. Quicken Overview

Intuit QuickBooks is the gold standard for small business accounting software. It’s what a lot of businesses start out with when they move from spreadsheets to an accounting software. Many accountants use it, too, and will recommend it to small businesses as a first accounting software.

Quicken is a widely-used personal accounting and budgeting software that offers a home and personal business accounting tool. The official line on Quicken Home & Business is that it’s “suitable for all business sizes,” but the features work best for small personal businesses and secondary income from rental properties. Because Quicken is primarily designed for personal use, its business capabilities are limited, but it could be just enough for those looking for a small business accounting software that helps them balance all their income.

This article compares how QuickBooks and Quicken approach the major small business accounting software features you need and ends with some tips on how to choose between them.

Budgeting

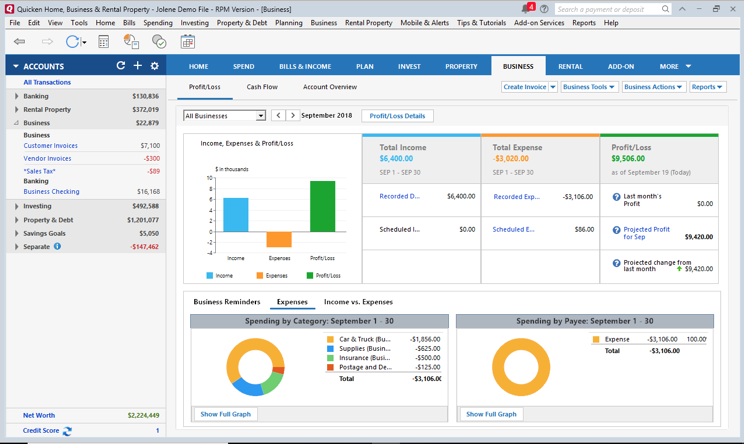

Quicken budgeting dashboard.

QuickBooks uses a dashboard to give a visual overview of accounting including current expenses, income, and upcoming bills. The software connects and compares profitability across projects to help businesses better understand their market and how they can improve their income over time. With integrations like QuickBooks Payroll and TSheets, companies can connect directly to their time clock tools and include payroll expenses in their budgeting.

Quicken Home & Business also uses a visual dashboard for budgeting. The tool recognizes recurring payments and expenditures and uses those plus any manual entries to personalize your budget requirements. Although they’re managed within the same interface, you can separate your home and business budgets. This improves overall budgeting strategy, makes it easier for you to pay yourself at the end of each month, and speeds quarterly or end of year tax filings.

Automatic bill pay

QuickBooks bill pay.

Small businesses have to automate, otherwise the principal owners will spend all their time working on their business and no time working in their business. An easy-to-automate feature for many businesses is bill pay for recurring expenses.

Users can access bill pay in Intuit QuickBooks with a Bill.com integration, or make ACH payments to vendors through the Quicken app. QuickBooks will pay bills automatically, but you pay extra for the Bill.com subscription. And while you don’t have to pay for them, you must manually approve ACH payments.

Quicken Home & Business offers free bill pay once you activate the tool on your account. For the less feature-rich Quicken plans like Starter and Deluxe, you can purchase bill pay for under $10 a month or access the feature through your bank.

Payroll

You’ll need payroll features as soon as you hire your first employee. This is for your protection as much as theirs as an oversight could cost you fees or interest payments if you fail to follow payroll laws or pay payroll taxes.

QuickBooks is designed for growing businesses, so the software includes several payroll options. You can use Tsheets by QuickBooks to manage employee timesheets, send 1099 forms to contractors for single or recurring projects, or sign up for payroll services. If you opt for the QuickBooks payroll tools, you’ll pay a small monthly fee. Alternately, you can sign on for full-service payroll guidance from an expert for a larger subscription price.

The Quicken Home & Business software does not include payroll. While it’s still a great tool for entrepreneurs and very-small-business owners, you’ll need to find another tool for payroll with your first hire and manually import your payroll expenses to include them in your budget.

Invoicing

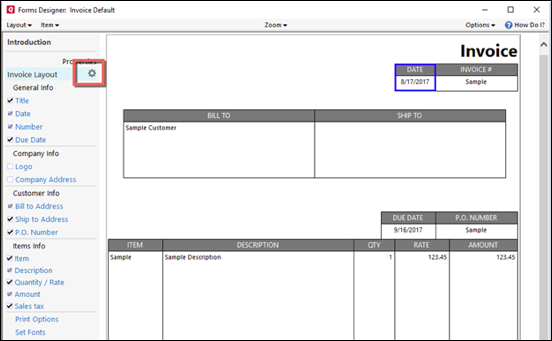

Design an invoice in Quicken.

QuickBooks has advanced invoicing and payment options that small businesses can use to get paid faster, including online payments and payment links within electronic invoices. Choose from several templates to build professional-looking invoices and brand them with your logo or company color palette.

Quicken has similar invoicing tools to QuickBooks. You can brand your invoices with a logo and links and include a payment link to PayPal. Choose recipients from the customer and vendor list feature, then save your custom invoices as templates to speed up the invoice process. Quicken automatically recognizes when you make new invoices within the tool and adds the outstanding payments to your budgeting tools, so you never lose track of a pending payment again.

Tax capabilities

QuickBooks sales tax summary.

QuickBooks divides its tax features into two different tools: sales tax and deductions. The sales tax feature automatically calculates sales taxes for product sales based on location, date, and category of the sale. Use the QuickBooks mobile app to track your deductions automatically and upload receipts. The Sales Tax Liability report gives you a clear overview of how much you’ll owe at the end of each period, so check this as you build your budget. The tax tools also prepare your tax statement to speed up your quarterly or annual filing.

Quicken has lots of tax reports in the Home & Business plan, including Schedules A-E and custom reports. Each of these will help you file faster and plan your expenses better. Quicken also provides a direct export to TurboTax, so you can save time during tax season. And because Quicken gives you a central tool to manage your personal and business accounts, it will automatically identify payments that qualify for business deductions.

Deployment

QuickBooks comes in two forms: a cloud browser app and an Enterprise-only desktop app. For any version of QuickBooks, you connect your accounts and investments to their secure server and all of your financial information ports in over the encrypted connection. You can also connect several outside apps for payroll, timekeeping, payments, and more. Small businesses can even access their business account on the go from the QuickBooks mobile app.

Quicken is available in desktop app. You can access a browser and mobile version of the tools, both of which are less feature-rich than the desktop version. Accounts sync across all three versions of the Quicken app, but you’ll find limited features in some versions of the tools. Quicken Home & Business is currently available only on Windows machines. Although Quicken must be downloaded to a computer, the tool does receive regular updates that are pushed to the system.

Make a decision: QuickBooks vs. Quicken

Whether you choose QuickBooks vs. Quicken depends on several factors, but foremost among them is growth. QuickBooks is a professional accounting tool built for companies who plan on growing significantly in the upcoming few years. With Quickbooks, businesses can increase their subscription plan based on their growth and needs.

On the other hand, Quicken is designed for solopreneurs and small business owners who do not plan on adding lots of staff in the next few years. Quicken can handle complicated business scenarios, but it lacks significantly in the payroll management areas. Choose Quicken if you have a hard time separating business from personal accounting, but the company isn’t big enough yet to support the purchase of a dedicated accounting tool.

Choosing the best small business accounting software

As a small business owner, you’ve got enough to do. Don’t spend much longer choosing your accounting software. Contact us today to get a short list of qualified vendors who will meet your needs. Our unbiased Technology Advisors are here to help.