It’s no surprise that B2B leaders name quality, revenue, and quantity as the most important objectives for effective lead generation. Lead generation is a profit engine, and how can you profit without a consistent output of qualified leads?

What is surprising, though, is how many companies still try to drive revenue through a faulty pipeline. Remember what they say about insanity?

It’s doing the same thing over and over again and expecting different results.

If you continually see recurring problems with lead flow, conversions, or revenue, don’t be insane. Stop and evaluate your sales pipeline.

Folks may refer to this process as “sales pipeline gap analysis,” but it’s really just a needs assessment in disguise. That means it’s time to sit down with key stakeholders (from marketing and sales) and identify which pipeline stages have the biggest issues, whether that be low volume, bottlenecking, latency, or attrition.

What strategies, tools, or partnerships could offer a solution? In other words, what does your pipeline need?

The Value of a Clear Sales Process

Before you troubleshoot anything, make sure your team has a documented, repeatable sales process in place. A recent study by Vantage Point Performance found an 18 percent difference in revenue between B2B companies with and without a formal sales process.

You can start by defining your sales pipeline stages, both on paper and in your CRM. The textbook approach is usually something along these lines:

Inquiry — > MQL (marketing qualified lead) — > SAL (sales accepted lead) — > SQL (sales qualified lead) — > Closed/Won deal

But you might also tweak some of the stages to reflect the nature of your product or buyer’s journey. A SaaS vendor, for example, might use “needs assessment, technical fit, demo, and contract negotiation” to describe their pipeline. As you reinforce these stages through process and technology, you should see an increase overall pipeline success. Considering 44 percent of executives call their sales pipeline management “inefficient,” a clear sales process gives you a pretty strong competitive advantage.

How to Check for Gaps

With a strong framework for pipeline management in place, you’ll have a much easier time identifying gaps. Your pipeline, of course, represents a continuum of revenue — from potential to realized. So a gap is basically any place that causes a deficit in revenue.

There are numerous reasons this can happen:

- Low volume: Not enough leads in a particular pipeline stage

- Attrition: Too many leads rejected as unqualified

- Bottlenecking: A high quantity of leads are getting stuck in one stage

- Latency: Leads go dormant after sitting untouched for a period of time

Every B2B company sees these problems at some point in the sales cycle, but it can be difficult to isolate the root cause. If you know your pipeline is lagging but aren’t sure where or why, use the five steps detailed below to find the gap.

1. CRM Reporting

Since you already use it to track leads as they move through the sales process, your CRM software is one of the most useful tools for finding pipeline gaps. Most CRMs offer built-in reports that show historical or real-time views of the sales pipeline.

Use these reports to evaluate how many potentials are in each stage, measure opportunities lost vs. won, assess team or individual performance, analyze historical trends, and much more.

If your CRM’s built-in reports don’t go deep enough, you can always try a bolt-on sales pipeline management app such as InsightSquared.

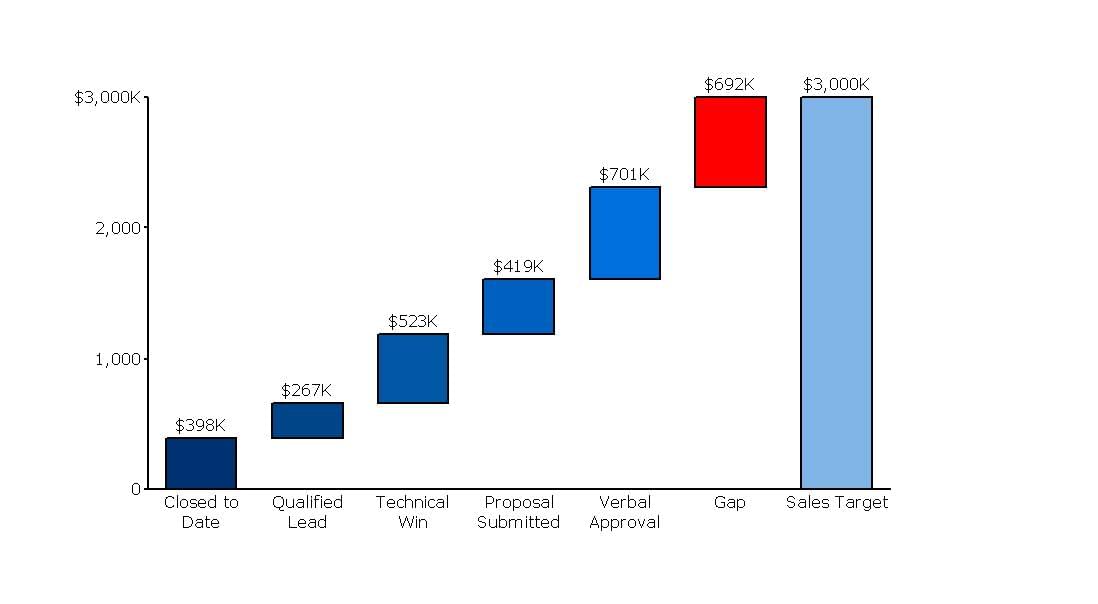

An example of a pipeline flow report in InsightSquared; shows pipeline value as you add, win, and lose opportunities

2. Check Your Forecasts

Another way to check for gaps is through sales forecasting. If you’re working toward a set monthly or quarterly goal (which you should be), periodic sales forecasts indicate whether you’ll miss, meet, or exceed that goal. It basically adds up the total value of current opportunities in your pipeline (and qualified leads, if you wish), and multiplies it by the probability that those deals will close.

The red bar represents the gap between forecasted revenue and the revenue required to hit the goal — $3 million, in this case. Image via Mekkographics.com.

The cascade chart above is a common representation of the sales forecast — just be sure your forecasts are based on accurate data. If your forecasts are off, you may underestimate potentially ruinous gaps or waste time compensating for ones that don’t exist. Less than half of all sales reps believe their current pipelines are accurate, and yet they spend about 2.5 hours a week creating forecasts, according to the TAS Group.

3. Evaluate Your MQLs

Since it’s humanly impossible for your sales team to do all their own prospecting, marketing qualified leads (MQLs) are a vital component of your lead generation strategy. In an ideal world, every MQL would be a decent match for your product/service, have a clear understanding of their needs, and have interest/intent to buy.

But that’s not always the case.

If the lead scoring rules aren’t properly calibrated, or if your marketing team doesn’t have a strong nurture process, then you’ll get a lot of MQLs that turn out to be duds, which means you’re wasting precious time and resources. According to an oft-quoted 2012 stat, 73 percent of B2B leads are not sales-ready.

How good are your MQLs? Do your sales reps follow up immediately because they’re eager to speak with a matched, interested decision-maker? Or do they complain about the quality and let marketing leads go cold? Do you get enough MQLs in the first place?

Here are a few important MQL metrics to consider:

- MQLs per channel (search, social, display, etc.)

- MQLs to opportunity (percent that convert into opportunities)

- MQLs to revenue (percent that convert into revenue)

4. Follow Your Opportunities

Let’s say your MQLs are excellent and plentiful. A large percentage become SALs (sales accepted leads), and even SQLs (sales qualified opportunities), which constitutes a sizable increase in opportunities. The temptation here is to celebrate prematurely: start adding up your pipeline value, forecasting revenue, and take your sales team out for drinks.

Not so fast.

Even in the opportunity stage, there’s still a possibility of attrition. That’s why it’s called an “opportunity,” not a “guarantee.” Don’t count your chickens before they hatch. A potential buyer may back out at the last minute because they don’t like the contract terms, or because another vendor offered a price break. When this happens with regularity, it creates a gap.

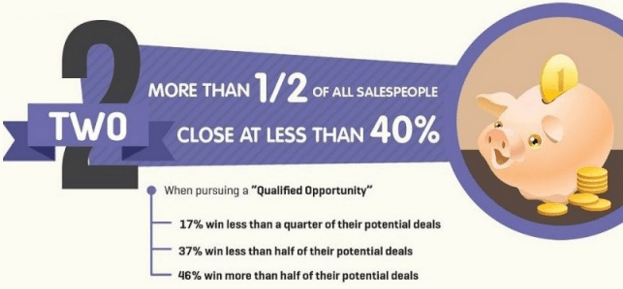

The metric you’re looking for here is a win/loss ratio: what percentage of your opportunities become won deals vs. lost deals? In the B2B world, 37 percent of salespeople close less than half of their potential deals. Are you happy with that percentage?

5. Analyze Lead Flow

B2B purchase decisions take time, especially when they’re high-cost or high-risk. But that doesn’t mean you should have hundreds of warm leads stagnating in the SAL stage for months and months. Generally speaking, your leads and deals should stay moving, or at least stay fresh (which means you need to keep checking in).

As enterprise solutions migrate to the cloud, become less expensive, easier to implement, etc., sales cycles will only get shorter. How long is yours, on average? How do your leads flow from one stage to the next — from inquiry to MQL, from MQL to SAL? How long does it take your SDRs to bring leads through the development process? Twenty-seven percent of salespeople say a long sales cycle is the biggest barrier to success, according to CSO Insights.

If you’re seeing bottlenecks in lead flow, there’s either a problem with your process or with the leads themselves. For example, a delay between the Inquiry and MQL stage could be a symptom of inbound efforts targeting the wrong audience (people from the wrong industry or without active projects).

How to Fill the Gaps

If you see gaps at the front end of the pipeline, it’s typically a volume issue — i.e., not enough leads are flowing in to begin with. Is there anything you can do to increase brand awareness through inbound or enhance your teleprospecting programs?

If you see gaps in the middle of the pipeline, where leads are transferred from marketing to sales, your lead nurturing/scoring process may need adjustment. Ensure sales and marketing are on the same page about scoring criteria and what defines a qualified lead.

If your gaps are at the end of the pipeline (where opportunities close), you may need to refine your development process. Are your SDRs doing everything necessary and possible to win deals? Do they need additional tools or resources to help close deals?

Lastly, another popular approach is to supplement your lead generation by working with an outside partner. About 61 percent of enterprises and 46 percent of small businesses use a combination of purchased and generated leads, according to MarketingAdvocate. With this approach, you bring in third-party leads to close gaps and invest more of your own resources into sales. Ideally, a third-party provider will let you specify targeting requirements, volume, and pipeline stage . . . at least, that’s how we do it. To learn more, check out our vendor page below and start filling gaps in your pipeline today.

__

Feature image credit: Ebbeson, Bill http://creativecommons.org/licenses/by/3.0/