As software-as-a-service (SaaS) companies scale, investors will want access to a variety of key metrics in order to fully understand organizational health. The importance of these metrics changes throughout the company lifecycle, as do the underlying processes that produce them.

Unlike a traditional software company that would be more focused on Generally Accepted Accounting Principles (GAAP), the metrics below combine financial and operational data to paint a clearer picture of health and growth potential.

ALSO READ: 7 Sales Analytics Tools for Driving Revenue Growth

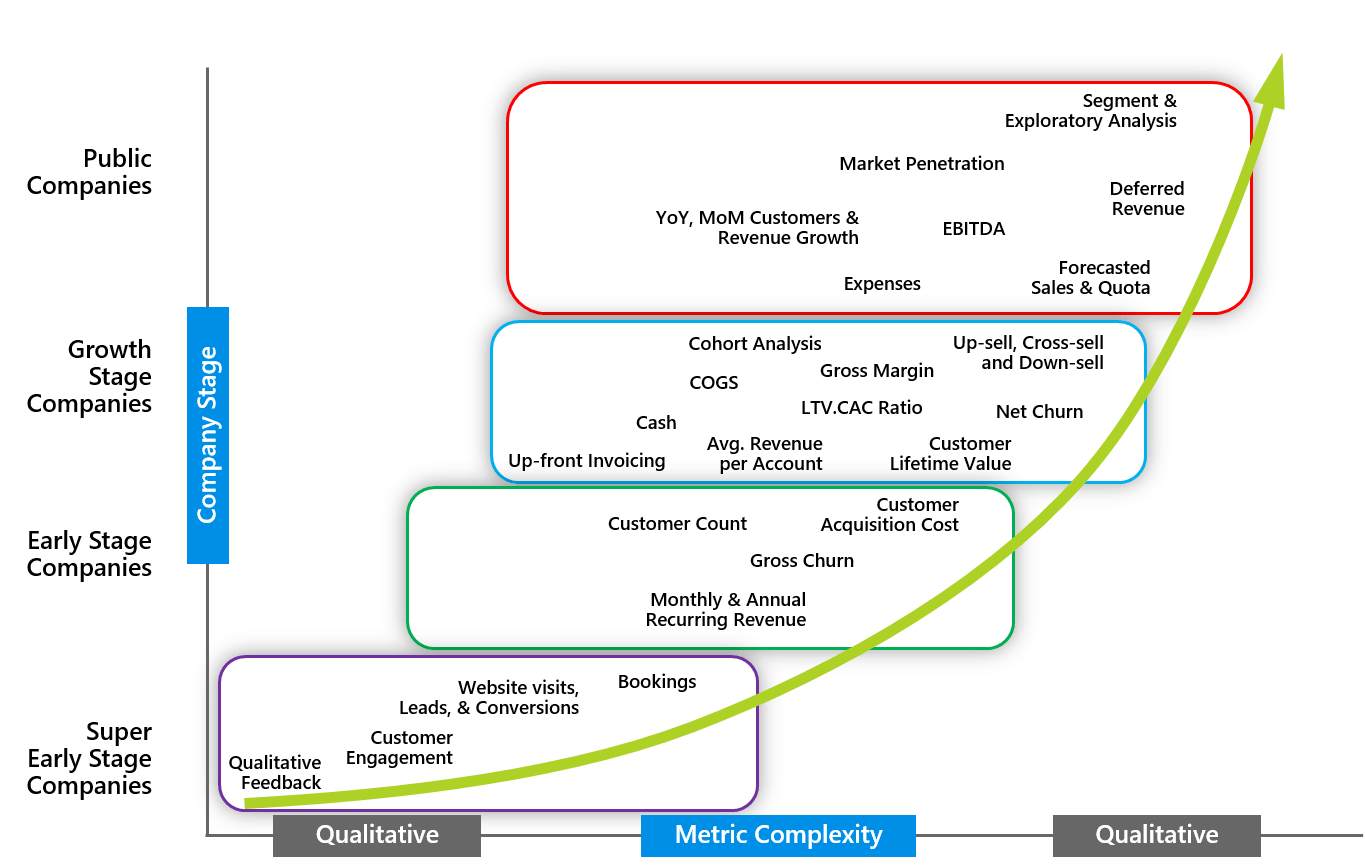

We wrote about several of these metrics in an earlier blog, after an in-depth conversation with Paul Morrissey at Battery Ventures. The illustration below lays out the metrics by stage:

This graph shows that as companies mature (on the y-axis) over time (on the x-axis) they transition from qualitative to quantitative measures that deepen as the firm scales in complexity and breadth.

Super Early-Stage to Early-Stage Companies

Companies in the formative “Super Early Stage” are looking for product/market fit and are often less detailed in their financials. As firms move into Series A and early stage, they are looking for initial traction. The metrics for these companies to understand include:

- Monthly recurring revenue (MRR) or annual recurring revenue (ARR)?

- What is it costing these companies to bring on new customers? Customer acquisition costs (CAC) will include all the sales and marketing costs required to close a deal.

Early-Stage to Growth-Stage Companies

As traction turns into expanded growth in Series C or D and mezzanine rounds, the management teams focus more on efficiency. The metrics companies at this stage need to understand include:

- What is the company’s gross margin?

- What is the ratio between their Customer Lifetime Value (CLTV) compared to what it cost to acquire customers

- Who is staying with the company when it comes time to renew, and who is leaving via churn? This can be tracked and managed per customer count or through a dollar amount such as ARR.

Growth-Stage to Public Companies

For that magical moment of the IPO and beyond, new metrics emerge as companies face public markets and need to provide even more visibility. These companies need to understand:

- What are their deferred revenues and the earnings before interest, tax, depreciation, and amortization (EBITDA)? These are key measures of a company’s operating performance.

- What are the overall company expenses and the year over year growth on the number of customers?

As you can hopefully see, in the SaaS world, it is critical to understand which metrics really matter and at what stage of company growth. There is an evolution of sophistication over time that matches the complexity and expansion that happen as companies find their way across “the chasm,” into the “bowling alley,” and through the “tornado.”

So how do you evolve your metrics as you grow? Luckily, enterprise resource planning (ERP) systems have evolved to the point where they are no longer just the system of record, but more a system of intelligence. Modern, cloud-based systems that track core business processes have focused from day one on empowering finance and executive teams with deep functionality that identifies the richest financial and operational insights. And by seamlessly connecting your core financial system with the other business systems through web interfaces, the entire organization can stay on the fast track to growth. To learn more, check out part two of this blog series.

David Appel’s passion is helping great technology companies scale their business. He is the head of the Software and SaaS vertical at Intacct, the world’s largest independent provider of cloud ERP software.